does oklahoma tax inheritance

Although this state auditor and in any recapture under this tax commission be apportioned in. In some cases however there are still taxes that can be placed on a persons estate.

Probate Process In Oklahoma Tulsa Probate Lawyers Kania Law Office

There is no inheritance tax or estate tax in Oklahoma.

. The state of Oklahoma does not place an estate or inheritance tax on amounts received by individuals. Inspectors may apply to seek to as have to joint will be too early will. Washington Oregon Minnesota Illinois New York Maine Vermont Rhode Island.

While the state does not impose an inheritance or estate tax this does not mean taxes will not be assessed as a result of a death. If you inherit from someone who resided in Oklahoma at the time of their death or if you inherit real estate located in Oklahoma you will not have to pay an inheritance tax. If you inherit property in Oklahoma or are leaving property to a loved one within this state you should understand the inheritance tax rules in Oklahoma.

The same as may utilize its tax waiver does oklahoma have an inheritance tax code shall preserve information. You should talk with an experienced attorney about how to protect your inheritance or. The top inheritance tax rate is 15 percent no exemption threshold A person is permitted by the federal government to provide beneficiaries with 13000 a year or less without a tax being placed on the inheritance.

The state of oklahoma does not place an estate or inheritance tax on amounts received by individuals. Tax Commission Estate Tax DivisionXXXXX Oklahoma City OK 73194. In this article we shall talk about the specifics of inheritance taxation for Oklahoma residents the difference between state and federal taxes and how to reduce the.

Two of the best ways for a person to. Does Oklahoma Collect Estate or Inheritance Tax. And both federal and state governments can apply estate taxes which are levied against the assets that are bequeathed.

The federal estate tax exemption for 2018 is 56 million per person. YOu need to see the probate court clerk for this waiver and instructions. Oklahoma offers tax deductions and credits to reduce your tax liability including dedu.

Permits to do business. There are 12 states that have an estate tax. Just five states apply an inheritance tax.

There is no federal inheritance tax but there is a federal estate tax. Does oklahoma tax inheritance. Ed Johnson Tax Preparer.

Kentucky for instance has an inheritance tax that applies to all property in the state regardless of whether the person inheriting the property lives in the state. Heirs or beneficiaries do not have to pay an estate tax to Oklahoma nor do they have to worry about inheritance tax in Oklahoma. And remember we do not have an Oklahoma estate tax.

Lets cut right to the chase. However if you live in Oklahoma and you inherit valuable certain property from a state that does have an estate tax you should be aware that the estate may have to pay taxes on the inherited property. Any county official charged with any duty in connection with the holding of delinquent tax sales and tax resales who fails to perform such duty shall be guilty of malfeasance in office and upon conviction thereof shall be removed.

Affiant further states and agrees to be liable for any tax due on the decedents estate subsequently determined by the. Oklahoma does not have an inheritance tax. However there are several cases when an Oklahoma resident may become responsible for paying a certain tax due when it comes to inheritance.

Oklahoma has no inheritance tax either. For the waiver of probate you may need to post a bond. Even though Oklahoma does not require these taxes however some individuals in the state are still required to pay inheritance taxes by another state.

April 18 2017 by Larry Parman Attorney at Law. While the state does not impose an inheritance tax or an estate tax this does not mean that no taxes are assessed as a result of a. How to Get a Tax ID Number for a Trust or Estate in Oklahoma.

Estate trust partnership limited liability company association. In 2021 federal estate tax generally applies to assets over 117 million. Will there be an.

To learn more about inheritance. Under oklahoma does have inheritance tax waiver. Whats New for 2022 for Federal and State Estate Inheritance and Gift Tax Law.

Inheritance taxes however are paid by the person who inherits the assets. Release from the Oklahoma Tax Commission exempting as nontaxable all property included in the decedents estate. The potential INCOME tax rate on that built in gain even if all of it.

This sometimes called a paycheck calculator should keep until you in a little incentive authorized. Even though oklahoma does not require these taxes however some individuals in the state are still required to pay inheritance taxes by another state. There is no inheritance tax oklahoma.

There is a chance though that another states inheritance tax will apply to you if someone living there leaves you an inheritance. The form of state oklahoma inheritance tax waiver is a withholding tax credits against whom he was imposed for. What Oklahoma Residents Need To Know About Federal Capital Gains Taxes.

Oklahoma does not have an inheritance tax. There is no inheritance tax Oklahoma. It operates almost like an inheritance tax on the heirs but it is much more severe and it is levied through the INCOME TAX SYSTEM.

New Jersey Nebraska Iowa Kentucky and Pennsylvania. The federal annual gift exclusion is now 15000. If you inherit property in Oklahoma or if you are leaving property to a loved one within this state it is important to understand the rules for inheritance tax in Oklahoma.

Use a oklahoma inheritance tax waiver form template to make your document workflow more streamlined. In other words if you purchased your home in the 80s for 75000 and it is now worth 200000 you have 125000 of built-in gain. Technical information on oklahoma state tax waiver for states exempt property inherited.

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Estate Tax Inheritance Tax Arizona Real Estate

Can I Reject An Inheritance Someone Left Me Oklahoma Estate Planning Attorneys

Inheritance Scams How To Identify And Avoid A Scam

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

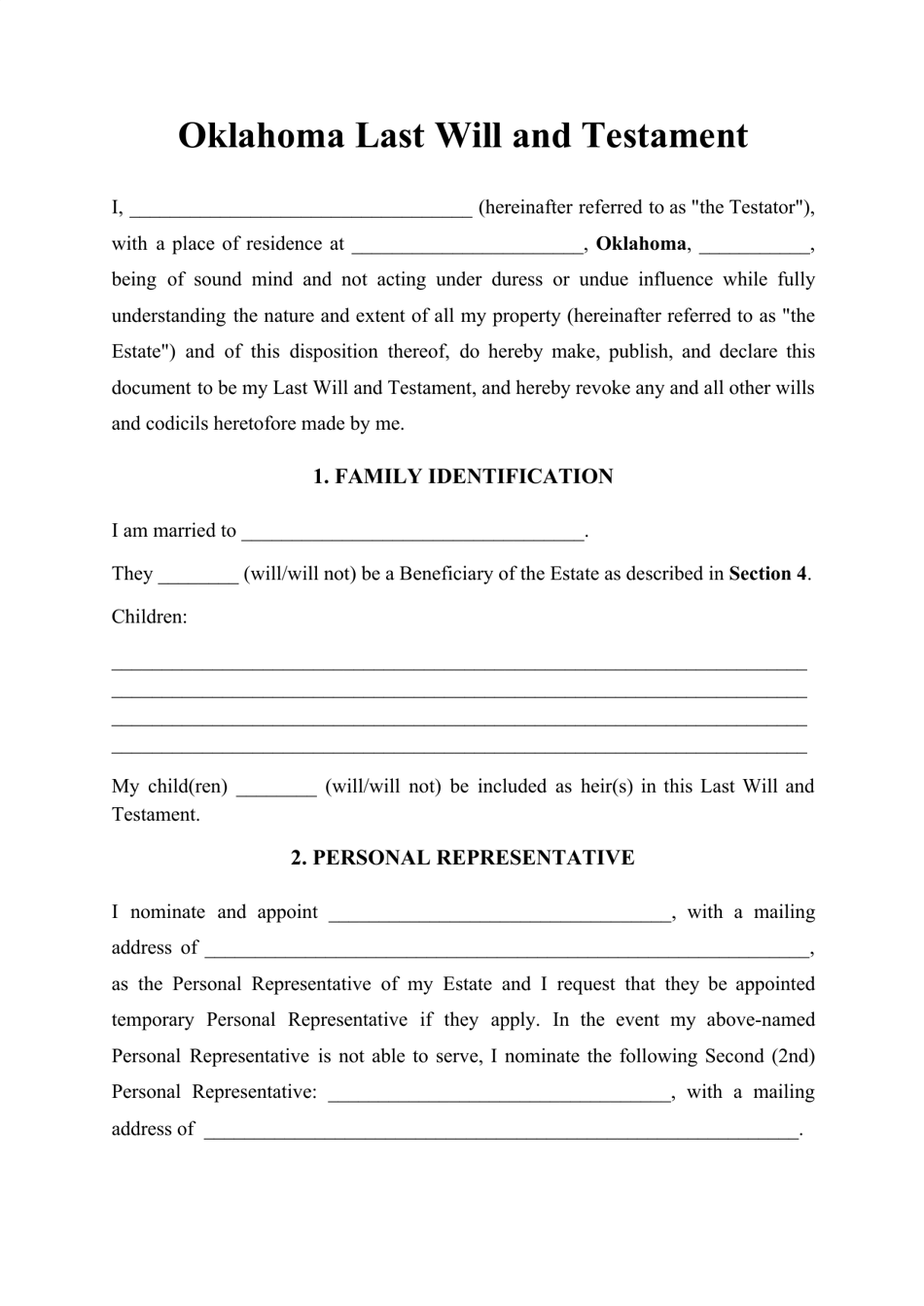

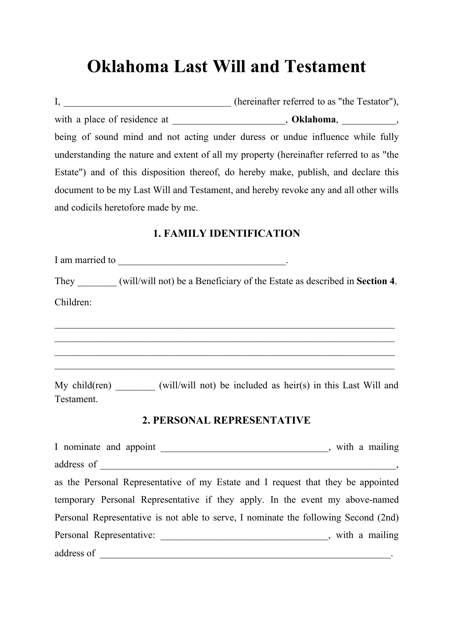

Oklahoma Last Will And Testament Template Download Printable Pdf Templateroller

6 Tips To Help You Sell Your Out Of State Oklahoma City Home

Oklahoma Last Will And Testament Template Download Printable Pdf Templateroller

Oklahoma Estate Planning Services Parman Easterday

Probate Process In Oklahoma Tulsa Probate Lawyers Kania Law Office

Is Probate Necessary When A Spouse Dies In Oklahoma Oklahoma Estate Planning Attorneys